The adoption of digital payment systems has the potential to transform Guyana’s financial landscape. By reducing reliance on cash, digital payments can enhance convenience, security, and inclusivity, especially for rural populations who lack access to traditional banking services.

Why Digital Payments Matter

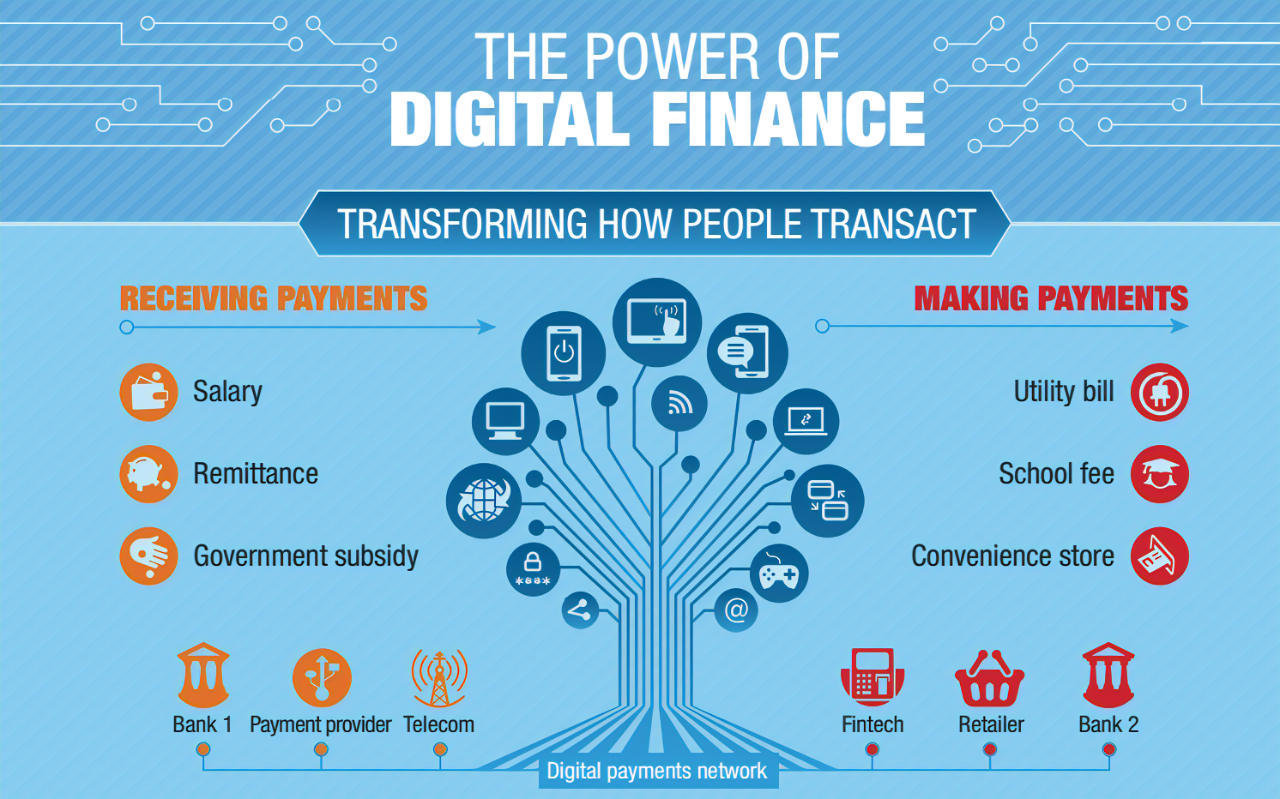

In Guyana, many people remain unbanked, relying on cash transactions that are time-consuming and insecure. Digital payment platforms, such as mobile wallets and online banking, offer a safer alternative. These systems allow users to pay bills, transfer money, and shop online without needing physical cash or a bank account.

For businesses, digital payments reduce operational costs and improve efficiency. Small vendors, for example, can use mobile payment apps to process transactions quickly and securely, expanding their customer base.

Challenges to Adoption

Despite the benefits, digital payment adoption in Guyana faces challenges. Limited internet access in rural areas hinders the use of online platforms. Additionally, many citizens are unfamiliar with digital payments, leading to mistrust and resistance.

The cost of smartphones and data plans also poses a barrier, particularly for low-income households. Without affordable access to technology, digital payment systems cannot reach their full potential.

Building Trust and Accessibility

Education and awareness campaigns are essential to build trust in digital payments. Workshops can teach citizens how to use payment apps safely, while government-backed guarantees can reassure users about data security.

Expanding mobile network coverage and offering affordable internet packages are also critical. Telecom providers can partner with financial institutions to subsidize smartphones and data plans, increasing access to digital platforms.

Government’s Role in Scaling Adoption

The government can accelerate digital payment adoption by digitizing its services. For instance, welfare payments and tax collections can be processed through digital platforms, encouraging citizens to transition from cash to electronic payments.

Policy incentives, such as tax breaks for businesses that adopt digital payments, can further promote usage. Collaboration with fintech companies can also drive innovation, creating tailored solutions for Guyana’s unique needs.

The Road Ahead

Digital payment systems have the power to boost financial inclusion and drive economic growth in Guyana. By addressing the barriers to adoption and building a supportive ecosystem, the country can unlock the full potential of this technology, ensuring that all citizens benefit from its convenience and security.